據(jù)悉,2019年9月23日,法國政府提出了一系列針對在線市場繳納增值稅的措施,這些措施將納入《2020年金融法》,以確保法國居民開始繳納從在線市場購買的商品增值稅。

根據(jù)法國公共會計(jì)部長Gerald Darmanin在訪問巴黎附近的亞馬遜交付設(shè)施時宣布的提議,從2021年起,在法國促進(jìn)第三方賣家和買家之間銷售的在線市場將承擔(dān)增值稅義務(wù)。

改革還將創(chuàng)建一份不符合某些稅收和報(bào)告要求的在線平臺黑名單。

此外,還要求物流倉庫記錄并保存10年內(nèi)的包裹起運(yùn)地和目的地,以及應(yīng)繳的增值稅額。

Gerald Darmanin表示,這些措施還將輔之以簡化措施,以確保電商參與人員廣泛遵守這些變化。

奧地利議會批準(zhǔn)數(shù)字稅

據(jù)悉,2019年9月19日,奧地利議會下議院批準(zhǔn)了一攬子稅收改革方案的第一部分,該方案將引入數(shù)字稅并改變某些增值稅規(guī)則。

從2020年起,奧地利將率先對在全球年銷售額超過7.5億歐元(約合8.2億美元)且數(shù)字廣告銷售額達(dá)2500萬歐元(約合2734.5萬美元)以上的公司征收數(shù)字稅。

從2020年開始,在旨在收緊數(shù)字經(jīng)濟(jì)稅收規(guī)則的措施中,數(shù)字平臺將對稅收披露義務(wù)承擔(dān)全部責(zé)任。實(shí)際上,這意味著預(yù)訂平臺將被要求向稅務(wù)機(jī)關(guān)報(bào)告所有銷售情況。

此外,該法案還取消了對低于22歐元的小批貨物進(jìn)口免征增值稅的規(guī)定。

根據(jù)另一項(xiàng)增值稅措施,電子出版物供應(yīng)的增值稅稅率將降至10%,與目前實(shí)體出版物的增值稅稅率相一致。電子出版物目前按20%的標(biāo)準(zhǔn)稅率征收增值稅。

Distance selling

The current threshold in Austria is 35,000 Euro (since 1 January 2011).

遠(yuǎn)程銷售閾值

奧地利從2011年1月1日起遠(yuǎn)程銷售閾值是35000EUR。

Current legal basis

In general, if goods are dispatched or transported from an EU-Member State to Austria by a foreign supplier or on behalf of a foreign supplier to the below-mentioned customers, the supplies of goods are generally taxable where the goods are located at the time when dispatch or transport of the goods to the customer begins.

For distance selling however, there are special rules. Article 3 (3) – (7) Austrian VATAct 1994 stipulates that the place of supply of goods dispatched or transported by or on behalf of the supplier from an EU-Member State to another is the place where the goods are located at the time when dispatch or transport of the goods to the customer ends. Distance selling regime applies to certain types of recipients (especially private individuals as Amazon final consumers).

目前法律依據(jù)

一般來說,如果貨物是由歐盟境外的(非歐盟,例如我們中國企業(yè))賣家在歐盟-成員國內(nèi)有倉儲,向奧地利消費(fèi)者銷售并從歐盟成員國倉庫發(fā)貨,則一般應(yīng)在歐盟境內(nèi)的貨物所在地(發(fā)貨國)征稅。

然而,第3(3)-(7)條奧地利VATACT1994的遠(yuǎn)距離銷售制度規(guī)定為由歐盟境外的賣家從位于歐盟-成員國(非奧地利的歐盟國家)倉儲向奧地利終端消費(fèi)者銷售并發(fā)送商品,遠(yuǎn)程銷售制度特別適用于作為亞馬遜B2C貿(mào)易的賣家。

Example例:

德國企業(yè)家或在德國有倉庫的中國企業(yè)家將貨物從德國轉(zhuǎn)移到奧地利的個人買家。一年銷售總額超過35000歐元的門檻,那么從超過35000歐開始的銷售額,則在奧地利須繳納增值稅。德國企業(yè)家或中國企業(yè)家必須為在奧地利注冊增值稅號并在奧地利繳稅,發(fā)給這些奧地利個人的發(fā)票必須顯示奧地利的增值稅稅率!

注:根據(jù)1994年《奧地利增值稅法》第6條第1款第27項(xiàng),沒有在奧地利建立業(yè)務(wù)或沒有永久地址的企業(yè)家沒有資格使用小企業(yè)計(jì)劃,(也即奧地利的小企業(yè)計(jì)劃不適合沒有奧地利倉儲的企業(yè)賣家。)

How to calculate the threshold

The delivery threshold must be calculated separately for each member country. When calculating the delivery threshold, only sales from distance selling regime should be taken into account.

Intra-community deliveries, charges for the delivery of new vehicles, charges for the delivery of excise goods and sales subject to differential taxation are excluded.

Entrepreneurs from other EU countries who deliver to private individuals in Austria must invoice with Austrian sales tax from the following time:

1. If the delivery threshold is exceeded in the previous year:billing with Austrian VAT from the 1st turnover of the current year.

2. If the delivery threshold is exceeded in the current year:Invoicing with Austrian VAT from the sales with which the delivery threshold was exceeded.

奧地利遠(yuǎn)程銷售閾值如何計(jì)算

每個國家發(fā)往奧地利的銷售額分開計(jì)算,然后把非奧地利國家發(fā)奧地利的銷售加總,用這個加總值來計(jì)算遠(yuǎn)程銷售額,看是不是超過奧地利閾值(35000歐元)。

庫存來自其他歐盟國家/地區(qū)的企業(yè)賣家符合如下其中一種情況,須開始注冊奧地利稅號并在奧地利繳納增值稅:

1.如果上一年超過遠(yuǎn)程閾值35000歐元:從當(dāng)年的第一筆營業(yè)額開始需在奧地利計(jì)算奧地利增值稅。

2.如果當(dāng)年超過遠(yuǎn)程銷售閾值,則從超過交貨閾值的銷售開始計(jì)算奧地利增值稅。

New EU regulation 2021

Please note that the threshold will be generally abolished beginning with 2021. That means from 2021 on distance sales will have to be taxed in each EU member state where the dispatch or transport ends.

2021年歐盟新法規(guī)

請注意,歐盟新法規(guī)從2021年開始取消該遠(yuǎn)程銷售閾值。這意味著從2021年開始,遠(yuǎn)程銷售將會在歐盟成員國按發(fā)貨國或目的國征稅,而不會存在這個銷售閾值。

Application for a tax account number or a VAT number

Following documents are required for application.

· Verf 19: questionnaire for the assessment procedure

In addition: indication of sales channels (e.g.homepage, catalogue etc.)

Note:distance sellers are usually not allocated a VAT number since they only need a tax account number to account for the VAT due. However, if they need a VAT number, they have to fill in form ‘Verf 19’ giving sufficient reasons for their request.

· Verf 26: specimen signature sheet

· Valid VAT number or certificate of registration as taxable person (entrepreneur) issued by the Tax Office of the country the entrepreneur has established his business in (original)

· Copy of the company statutes

· Copy of the manager’s passport / ID

· Copy of the certificate of registration

申請奧地利增值稅號需要什么注冊資料?

申請需要以下文件:

·(1)評估問卷(Verf19)

注意:遠(yuǎn)程銷售商通常稅局不下發(fā)增值稅號, 但是,如果他們需要一個增值稅號,則必須填寫“ Verf 19”表格,以充分說明其要求。

·(2)申請簽名表(Verf 26)

·(3)公司在其國家/地區(qū)開展業(yè)務(wù)的國家/地區(qū)的稅務(wù)局簽發(fā)的有效的增值稅號或注冊證明(應(yīng)納稅人)

·(4)公司章程的掃描件(備用)

·(5)法人護(hù)照/身份證復(fù)印件

·(6)公司營業(yè)執(zhí)照復(fù)印件

Tax Representative

The appointment of a Fiscal Representative is only mandatory if the supplier has no permanent address, seat or fixed establishment in an EUMember State and if there is no appropriate mutual agreement procedure. The fiscal representative has to be an authorized recipient as well.

稅務(wù)代表

只有在賣家在歐盟成員國內(nèi)沒有固定地址,所在地或固定機(jī)構(gòu)并且沒有合法的雙方協(xié)議的情況下,才必須任命財(cái)務(wù)代表。財(cái)務(wù)代表也必須是授權(quán)作為稅局信件的收件人。

Disclosure/ Report of Incorrect or Incomplete Tax Declaration

If you have exceeded the Austrian distance selling threshold of EUR 35,000 Euro in previous years, but have not declared these supplies in Austria, you have to subsequently correct this and declare them in Austria. You can either report an incorrect or incomplete tax declaration to the tax authorities or fully disclose these supplies.

披露/報(bào)告不正確或不完整的納稅申報(bào)表

如果您在過去幾年中超過了奧地利遠(yuǎn)距離銷售35,000歐元的門檻,但尚未在奧地利申報(bào)這些銷售,則必須隨后更正此狀況并在奧地利申報(bào)。您可以向稅務(wù)機(jī)關(guān)報(bào)告不正確或不完整的納稅申報(bào)單,也可以完全披露這些銷售狀態(tài)。

Submission of VAT Returns

In Austria there are VAT advance preliminary returns and VAT annual final returns.

· a. Preliminary VAT return

· b. Annual VAT return

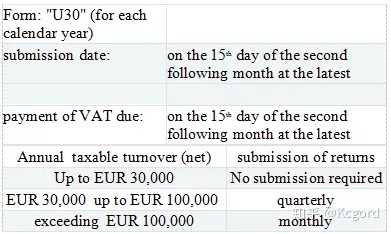

提交增值稅申報(bào)表

在奧地利,增值稅申報(bào)須提交預(yù)付款初報(bào)和增值稅年報(bào)稅表。

--預(yù)付款初報(bào)(也即月報(bào)或者季報(bào))

(1)截至申報(bào)日期是下個月的第二個月15日,(例如5月的銷售報(bào)告,須在7月15日之前提報(bào))

(2)應(yīng)繳增值稅:最遲在下個月的第二個月15日付款

?年度應(yīng)納稅營業(yè)額(凈額)申報(bào)表

1.如果一年稅前銷售額小于35,000歐元無需提交月報(bào)或者季報(bào)。

2.如果一年稅前銷售額大于35,000歐元小于100,000歐元,則可以季度申報(bào)。

3.如果一年稅前銷售額超過100,000歐元,則須月報(bào)。

--增值稅年報(bào)稅表(也即年報(bào))

可以通過線上或者紙質(zhì)郵寄提交方式提交。網(wǎng)上提交的截至日期是下一年的6月30日,紙質(zhì)郵寄提交的截至日期是下一年的4月30日。(來源:跨境稅法高文)

以上內(nèi)容屬作者個人觀點(diǎn),不代表雨果跨境立場!本文經(jīng)原作者授權(quán)轉(zhuǎn)載,轉(zhuǎn)載需經(jīng)原作者授權(quán)同意。

(來源:跨境稅法Goman)